Gold exports through “private transactions” jumped some 676 percent, from $388 million to $3 billion last year, with some attributing the surge to investors selling their holdings due to a price rise, and others suggesting a potential link to gold smuggling to Vietnam.

In its Asian Development Outlook report, issued last week, the Asian Development Bank noted a 16.5 percent surge in Cambodia’s overall merchandise exports.

“Private gold sales were the main reason for the rise in exports. Excluding these sales, merchandise exports declined by 1.1%,” the report says.

ADB country director Sunniya Durrani-Jamal said gold exports were valued at $3.01 billion in 2020, significantly higher than in previous years.

Exports in 2019 were $387.7 million, and average exports from 2016 to 2019 were $204.6 million per year, she said.

“The gold sales were private transactions and were not linked to [transactions by] the Royal Government of Cambodia or National Bank of Cambodia,” Durrani-Jamal said, adding that in 2020 Cambodia turned from a net importer of gold to a net exporter.

“Cambodia is not a major gold producer so the import and export of gold is related to private savings and investment decisions,” she said.

Though the ADB does not have detailed information about gold sales, Durrani-Jamal pointed out two possible drivers of the trend.

“Firstly, the sharp increase in gold prices during 2020 may have encouraged investors in Cambodia to sell their gold holdings and realize a profit on their investment. Secondly, some investors may also have been motivated by a need for liquidity to support other ongoing or planned activities,” she said.

Jayant Menon, a senior economist at the Singapore-based ISEAS-Yusof Ishak Institute and formerly at the ADB, said gold still serves as an important store of wealth in Cambodia “given dollarization and a weak financial system.”

And transactions of gold, including exports, are expected to rise during periods of crises, such as pandemics, he said.

“While it is difficult to assess if smuggling activity has been affected, we should not be surprised that the volume of legal trade in gold has increased during this difficult and prolonged COVID-19 crisis,” Menon said.

Others, however, pointed to alleged gold smuggling from Singapore through Cambodia into Vietnam as being behind the rise.

Stephen Higgins, founder of Mekong Strategic Partners and former CEO of ANZ Royal Bank, said shipping gold through Cambodia had a long history.

“For some time Cambodia has been a transhipment point for gold going into Vietnam. The spike in exports in 2020 may simply reflect stronger border controls due to Covid,” he said.

George McLeod, managing partner at corporate investigations firm Access Asia, said he doubted Cambodian investors had sold off $3 billion worth of gold last year.

“None of the figures I have seen show any significant anomalies in terms of gold sales from Cambodia. The main issues related to Turkey, Kazakhstan and Russia. More likely is that the gold was brought in from Singapore and exported abroad,” said McLeod, who has investigated Cambodia’s gold trade.

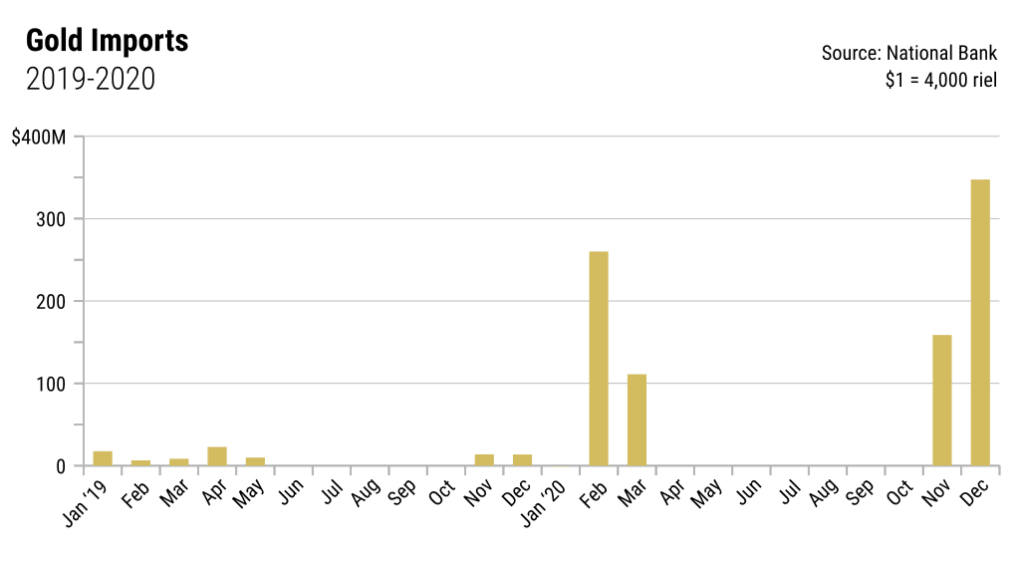

Official records of gold imports were up and down in 2020, according to National Bank statistics, spiking in February to 1 trillion riel, or about $250 million, making it the highest-valued import category, exceeding even fabrics. It also spiked in December to 1.4 trillion riel, or about $350 million. But there were zero gold imports recorded from April to October.

The shipment of gold from Singapore through Cambodia to more restrictive markets has been reported since the 1990s, and the U.N. Comtrade database has Singapore reporting $2.1 billion, $3.9 billion and $1.1 billion of gold exports to Cambodia in the three years between 2017 and 2019.

Cambodia reported just $186 million total gold imports from Singapore during those same three years, according to the U.N. database, which does not yet have figures for 2020.

Commerce Ministry spokesperson Penn Sovicheat said his ministry does not control the import and export of gold.

Finance Ministry spokesperson Meas Soksensan said gold exports had increased “because of world demand and opportunity” and there was no tightening of controls on gold exports. About the alleged gold smuggling, he said the ministry would respond only based “on the facts and not on allegation.”

McLeod said Cambodia’s 2020 gold exports were likely the result of strong economic growth in Vietnam and rising gold prices creating increased demand.

“Vietnam’s economy was one of the few success stories in 2020, due in part to its successes of controlling Covid-19,” he said. “If I was a Vietnamese billionaire, I would not want my net worth to be denominated in dong — a currency that is in perpetual decline due to the government’s policy of depressing the currency to increase exports.”

The smuggling route through Cambodia had been driven by Vietnam’s rigid controls: All gold must be sold through the state monopoly and gold imports are taxed at about 7 percent, McLeod said.

“Cambodia has a long history of gold smuggling and some of the country’s wealthiest tycoons began as gold smugglers. The scheme typically involves importing gold from Singapore (which is a global hub for the gold trade) and using connections to smuggle it into Vietnam,” he said.

“It is driven by Vietnam’s taxes and protectionism around gold, and Cambodia’s lack thereof. Other factors include the Cambodian elite’s long-standing connections in Vietnam that facilitate evasion of border controls.”

Updated at 6:02 p.m. with Finance Ministry response.